Larry Bellomo Law Offices

January 28, 2018

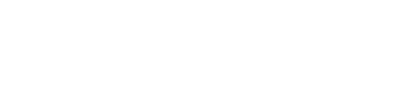

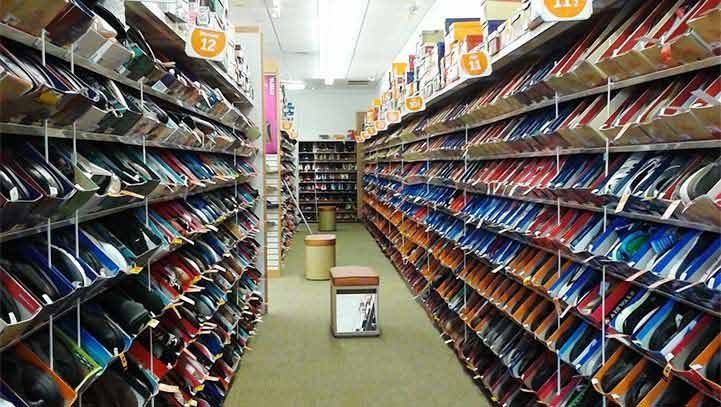

January 28, 2018 According to an October 27, 2017, announcement, the Los Angeles jeans company, True Religion, exited Chapter 11 bankruptcy with about $357 million less debt, debt maturities extended, cash to implement a growth plan and a positive outlook for the future. The company emerges with a reduced retail footprint and an exit loan of $60 million from Citizens Bank, the same bank that provided the initial cash during the reorganization process. At the peak of the company, True Religion jeans were selling anywhere from $150 to $250 a pair at their nearly 140 stores and online. The brand also sold at upscale department stores, such as Bloomingdales, Saks Fifth Avenue and Nordstrom and at other locations in the U.S., Mexico and South America. Around 2013, True Religion, like many other apparel stores, struggled for success, watching sales decline as it competed with the internet, online shopping and competing discount retailers. The rapid growth in the trend of athletic wear for leisure caused the sales of blue jeans to quickly decline. Behind $192,000 on rent for its California office headquarters and drowning in major debts owed to creditors, manufacturers, U.S. Customs and Border Protection and malls around the country, True Religion filed for bankruptcy on July 5, 2017, in a U.S. Bankruptcy Court in Delaware. At the time of filing, the company had 128 stores in the United States and 11 stores outside the country. The company made some major changes, hiring John Ermatinger as CEO and president and bringing on a new chief marketing officer and a new vice president of sourcing. They also reduced costs, streamlined processes and closed unprofitable stores. John Ermatinger publicly thanked the company’s supporters — consumers, employees, vendors and suppliers — for their ongoing commitment and devotion to True Religion. He expressed his excitement regarding the future of the company, which includes implementing new growth strategies through innovative partnerships, expanding True Religion’s digital presence and refining its marketing operations. You do not have to be a major corporation to file bankruptcy , Like in the case of True Religion, bankruptcy allows individuals to emerge in a better financial position than before. Our legal team can help you navigate through these difficult times.

December 23, 2017

December 23, 2017 The 32-year-old mother entered the high rise in downtown Memphis as a memory tugged at the far corners of her mind. Suddenly, it came to her. She had been in this very building with her own mother for the same purpose — to file bankruptcy . She anguished over the decision but a court order had recently enforced a judgement against her that allowed a company to seize a portion of her check. With her struggle to make ends meet, the judgment would put an unbearable strain on her already overburdened finances — the proverbial straw that broke the camel’s back. Despite the stigma, she decided that bankruptcy would stop the vicious cycle of juggling bills each month so that she could now start fresh. She even dreamed of becoming a homeowner one day. While the U.S. Bankruptcy Court for the Western District of Tennessee in Memphis funnels millions of dollars to the court, the lawyers and the creditors, the debtors for whom the entire system exists don’t fare so well. The clients are stuck in a vicious cycle. Most people choose to file Chapter 7, which allows the person to start over from square one without seizing any debts. In contrast, Chapter 13 requires monthly payments while stopping car repossessions and home foreclosures. This method is most common in the South and was what this mother chose. She didn’t understand the difference between the two. However, filers who opt for Chapter 13 must continue making payments for five full years. Most cannot even last 12 months under the program. These individuals went through each and every step of the bankruptcy — paying filing and legal fees and dealing with a seven-year blemish on their credit record — but do not ultimately benefit from the program. Once they have defaulted, they revert back to all unpaid debts with interest rates higher than ever. When comparing Caucasian filings with African-American filings, the latter usually file under Chapter 13 but cannot complete the program. Some return for repeat filings, with a few filing Chapter 13 up to 20 times during their lifetimes. They view bankruptcy as a last resort. If you are considering bankruptcy, talk to our knowledge attorneys about which options — Chapter 7 or Chapter 13 — is best for you.

December 4, 2017

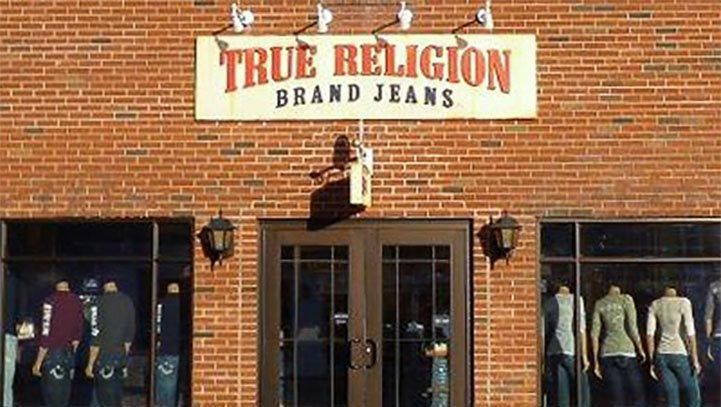

December 4, 2017 Another retailer, Toys “R” Us, sought Chapter 11 bankruptcy protection on September 18, 2017. The store joins a growing list of brick-and-mortar retailers that has succumbed to the pressures of long-term debt, which they listed at more than $5 billion. The parent company owns Babies “R” Us and cited stiff competition from other big box stores, such as Walmart, and the online presence of Amazon, as a reason for their financial woes. However, the giant toy retailer could not overcome the mountain of debt “$6 billion” they incurred during a leveraged buyout in 2005. They submitted the paperwork in Richmond, Va., to the federal bankruptcy court . The company needed to make a payment in 2018 of $400 million as part of their agreement. They sought independent counsel from a legal team in order to address these issues. A statement from the retailer indicated that they still hope to pursue growth over the long term. Additional retailers that have filed bankruptcy in 2017 include rue 21, a teenage clothing store; Gymboree, a children's clothing store; and Payless ShoeSource. Some companies have released tens of thousands of workers and closed thousands of stores in an effort to remain competitive in this market and to reduce costs. Babies “R” Us and Toys “R” Us stores number about 1,600 globally. The company has given no indication that they will close any of these. Banks and lenders, including JPMorgan Chase, will back the retailer with $3 billion so that they can keep paying employees and suppliers. The company CEO released a statement that he hopes that the company can move forward as they address their financial problems by seeking bankruptcy protection. Changing business and retail markets have affected brick-and-mortar businesses in the current retail climate. These effects from businesses can trickle down to individuals, impacting their income and standard of living. In other cases, people struggle with unforeseen medical bills that completely overwhelm them. In these situations and in business-related matters, Chapter 7 or Chapter 11 bankruptcy protection might offer you options and hope for the future. Contact our legal team today to find out how we can help.

November 6, 2017

November 6, 2017 Payless ShoeSource has eliminated half of its $847 million in debt and is moving forward with plans to open new stores in Latin America, including 22 in Nicaragua , the Dominican Republic, and Peru, as well as venturing into new markets in Asia. As one of the largest stores to ever emerge from bankruptcy, they are using a risky strategy that sounds counter-intuitive in a crowded retail market amid burgeoning competition from online stores. Despite having only 400 stores in Latin America, the region boasts 40 percent of the chain’s global profit, the most growth for the company. Payless’ strategy will focus mostly on bricks-and-mortar stores in a highly competitive US market with record store closings, bankruptcies of large franchises, and fierce competition from e-commerce companies, such as Amazon. The company closed approximately 700 mall-based stores over the course of the bankruptcy but will open four new mega stores in the US on top of their 3,200 existing global locations. The corporation will invest $234 million during the next five years of its expansion, including improving its online sales. Because Payless relies on customer loyalty and repeat customers, they don’t worry about in-store sales suffering from competition with e-commerce. Emerging from federal bankruptcy provides the company with better terms, vendor contracts and lease agreements. During bankruptcy, many landlords reduced rent by up to 50 percent while vendors increased trade credit by 60 to 75 days. However, the company’ s past financial woes and the competitive retail space still leaves a small margin for error and doesn’t take into consideration any potential negative surprises. According to Thomson Reuters LPC data, while Payless slashed its debt in half during its bankruptcy, $280 million of new term loans carry yields between 7 and 9 percent, similar to other struggling retail chains, but still above the average term loan yields of 3.6 percent. In a changing economic climate, personal or business bankruptcy might provide a viable alternative for debt reorganization . If you are considering bankruptcy, our legal team can help. Contact us today to discuss your options and move toward a positive financial future.

Recent posts

January 28, 2018

January 28, 2018 According to an October 27, 2017, announcement, the Los Angeles jeans company, True Religion, exited Chapter 11 bankruptcy with about $357 million less debt, debt maturities extended, cash to implement a growth plan and a positive outlook for the future. The company emerges with a reduced retail footprint and an exit loan of $60 million from Citizens Bank, the same bank that provided the initial cash during the reorganization process. At the peak of the company, True Religion jeans were selling anywhere from $150 to $250 a pair at their nearly 140 stores and online. The brand also sold at upscale department stores, such as Bloomingdales, Saks Fifth Avenue and Nordstrom and at other locations in the U.S., Mexico and South America. Around 2013, True Religion, like many other apparel stores, struggled for success, watching sales decline as it competed with the internet, online shopping and competing discount retailers. The rapid growth in the trend of athletic wear for leisure caused the sales of blue jeans to quickly decline. Behind $192,000 on rent for its California office headquarters and drowning in major debts owed to creditors, manufacturers, U.S. Customs and Border Protection and malls around the country, True Religion filed for bankruptcy on July 5, 2017, in a U.S. Bankruptcy Court in Delaware. At the time of filing, the company had 128 stores in the United States and 11 stores outside the country. The company made some major changes, hiring John Ermatinger as CEO and president and bringing on a new chief marketing officer and a new vice president of sourcing. They also reduced costs, streamlined processes and closed unprofitable stores. John Ermatinger publicly thanked the company’s supporters — consumers, employees, vendors and suppliers — for their ongoing commitment and devotion to True Religion. He expressed his excitement regarding the future of the company, which includes implementing new growth strategies through innovative partnerships, expanding True Religion’s digital presence and refining its marketing operations. You do not have to be a major corporation to file bankruptcy , Like in the case of True Religion, bankruptcy allows individuals to emerge in a better financial position than before. Our legal team can help you navigate through these difficult times.

January 16, 2018

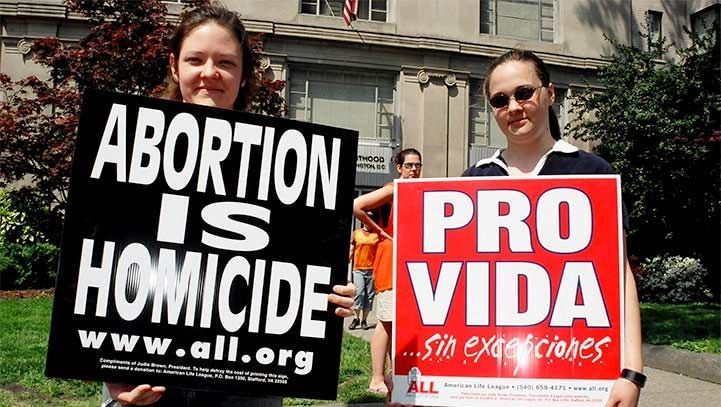

January 16, 2018 A Fresno State professor who intimidated a pro-life group was ordered to pay $17,000 and attend training on the First Amendment. He was recorded on video in an attempt to harass pro-life students who were drawing with chalk on the sidewalk. He also asked students from his public health class to assist him in his efforts. He claimed they were outside of the campus free speech area, but no such area has existed on campus since 2015. The sidewalk messages suggested pro-life options for students. The president of the club stated that the First Amendment gives students the right to speak on campus. She documented an incident between herself and the professor on video. He can be heard telling her that she is not in a free-speech area. However, she claimed that she had school permission to be there and to be speaking. The professor began erasing the sidewalk messages with his shoe. He told her that she did not understand the areas where free speech was permitted on campus. Alliance Defending Freedom acted as legal representation for the group, the Fresno State Students for Life. The professor must pay $1,000 to the president and $1,000 to another student as well as legal fees. However, he said that the money was paid by his insurance company, so he is not concerned about the legal fees. He does not admit to any wrong actions but is willing to attend the training so that he can learn the opinions and thoughts of others. The president expressed her relief that he will not be able to harass them again and explained that the case was not about winning money. She was extremely surprised at his actions, especially on a public campus. She further opined that professors should encourage and not prohibit free speech. Legal counsel for the pro-life group stated that the professor’s behavior flagrantly violated the First Amendment He added that school officials do not have the right to restrict freedom of speech on campus. The school did not comment about the case. If you believe that your First Amendment rights have been violated, you will need experienced legal representation to defend you. Contact us so that we can discuss your case.

January 5, 2018

January 5, 2018 The complexities of any divorce include dividing money, property and assets between both parties. While this might not be as complex for a millennial as it is for a couple who has spent their lifetime acquiring possessions, both types of divorce require finding a qualified family lawyer to deal with the personal issues. Legal experts report that stereotypes claim that other generations are more loyal than millennials who don’t really value traditions. She continues that even though they wait to marry, they still place a high priority on the institution. However, she added that they will not tough out a relationship the way their parents did. This by no means makes a divorce any easier for millennials. They feel just as hurt and disappointed as any others who divorce , but their outlook for the future tends to be more optimistic. Although marriage rates in the U.S. continue to decline, divorce rates are also dropping. Millennials delay marriage until later in life, placing an emphasis on education and careers before taking this significant life step. Millennials tend to be more open to diverse relationships, including living together. In the past, prenuptial agreements held a negative connotation as if one of the parties expected the marriage to end. The more-practical millennials, who prioritize acquiring and preserving wealth, see the prenup as a planning tool and communication map to manage financial expectations and interests. Creating a prenup with a lawyer realistically deals with the uncertainty of the future and helps a couple draft specific plans. Millennials choosing to live together instead of marrying can benefit from an attorney’s expertise when drawing up a cohabitation agreement, protecting both parties and their assets in case the relationship ends. When couples know the laws regarding cohabitation , marriage and divorce in their state, they tend to be ready for even unexpected contingencies. Whether a couple plans to cohabitate, marry or file for divorce, planning for a big relationship step helps the individuals prepare for the future, no matter what happens in the marriage. Consulting with a knowledgeable, experienced family lawyer sets up both parties for success.

December 23, 2017

December 23, 2017 The 32-year-old mother entered the high rise in downtown Memphis as a memory tugged at the far corners of her mind. Suddenly, it came to her. She had been in this very building with her own mother for the same purpose — to file bankruptcy . She anguished over the decision but a court order had recently enforced a judgement against her that allowed a company to seize a portion of her check. With her struggle to make ends meet, the judgment would put an unbearable strain on her already overburdened finances — the proverbial straw that broke the camel’s back. Despite the stigma, she decided that bankruptcy would stop the vicious cycle of juggling bills each month so that she could now start fresh. She even dreamed of becoming a homeowner one day. While the U.S. Bankruptcy Court for the Western District of Tennessee in Memphis funnels millions of dollars to the court, the lawyers and the creditors, the debtors for whom the entire system exists don’t fare so well. The clients are stuck in a vicious cycle. Most people choose to file Chapter 7, which allows the person to start over from square one without seizing any debts. In contrast, Chapter 13 requires monthly payments while stopping car repossessions and home foreclosures. This method is most common in the South and was what this mother chose. She didn’t understand the difference between the two. However, filers who opt for Chapter 13 must continue making payments for five full years. Most cannot even last 12 months under the program. These individuals went through each and every step of the bankruptcy — paying filing and legal fees and dealing with a seven-year blemish on their credit record — but do not ultimately benefit from the program. Once they have defaulted, they revert back to all unpaid debts with interest rates higher than ever. When comparing Caucasian filings with African-American filings, the latter usually file under Chapter 13 but cannot complete the program. Some return for repeat filings, with a few filing Chapter 13 up to 20 times during their lifetimes. They view bankruptcy as a last resort. If you are considering bankruptcy, talk to our knowledge attorneys about which options — Chapter 7 or Chapter 13 — is best for you.

Archive

Tags