Larry Bellomo Law Offices

March 18, 2015

March 19, 2015 Health insurance giant Blue Shield of California has been stripped of its tax exempt status in California. The surprising move came following a backroom investigation by the California Franchise Tax Board. Apparently the company was notified in August but the news was kept secret until being reported on Tuesday. Though extremely rare, this action is not completely without precedent. In 1986, tax reform passed by Congress targeted Blue Cross and Blue Shield, stripping them of their federal exemption. Some number of years following this move, Blue Cross went on to convert to a for-profit organization in California. However that was voluntary, setting it apart from the case at hand. Though no reasons have officially been cited, there are many speculated possibilities as to why the tax board felt compelled towards this , the center of which is the question: would California tax payers be better served with Blue Shield of California as a for, or not-for profit entity? The answer starts becoming clear if one looks into the financial reports for the company. Over the last decade, Blue Shield has contributed a fraction of their current financial holdings – around $325 million. Sounds like a lot, but not when considering that the company has around $4.2 billion in the bank, not so much. This fact led the company’s director of public policy, Michael Johnson, to step down from his post last week and go public with his concerns over the disconnect. “We’re talking about a $10 billion public asset, and the only real return the public is getting is $35 million in charitable contributions each year? That’s just a lousy deal…It’s time to cash in that asset.” Johnson went on to say that “for over 70 years, Blue Shield has been a tax exempt entity, subsidized by taxpayers in order to provide benefits to the public…but it’s demonstrated that it’s either unwilling or incapable of serving the public good.” Blue Shield will be protesting the decision, but with all that cash in the bank, executive compensation packages into the multi-million dollars annually and premiums on an upward trend, they might find it difficult to garner sympathies. Larry Bellomo is a Laguna Hills Bankruptcy and Family attorney who has become a trusted legal source over his 34 years of experience serving Orange County. If you are in need of legal help, give us a call, send us a message or visit our Laguna Hills offices and receive a 100% free , no obligation consultation. Featured Image: KPBS.org Words by: Jacob Wisdom

March 14, 2015

March 15, 2015 Administrators of the California state bar are considering a requirement that all students must volunteer 50 hours to free or “substantially reduced rate” legal work . They would need to meet the requirement within one year of receiving their license to practice law. Those in support of the requirement argue that it would enable those who cannot afford legal counsel to receive it, that the experience would make students better lawyers and that it would instill an understanding within the students towards the importance of serving low-income residents. California is not the first state to consider such a requirement. New York already adopted a 50-hour pro bono requirement which came into effect January 1, 2015 . Some legal aid experts are not completely onboard with the requirement. Kirsten Kreymann is the pro bono director at Public Law Center in Santa Ana . She says that while “[they] want to provide as much high-level legal service for our community as we possibly can…we need the money to do it.” Kreymann is referring to a disconnect between available space/resources, and available volunteers. There are about 100 legal aid organizations in California. The Legal Aid Foundation of Los Angeles is one of the largest, yet accepts only about 10% of volunteer applications from law students. In a way this makes it more prestigious (certainly more exclusive) than even the most desirable law schools (such as Harvard Law, which has an acceptance rate of about 15% ). The pro bono requirement is designed for civil cases rather than criminal. The reason being that criminal cases include the right to the attorney – a benefit not given to those engaged in civil suits. For all the noise on both sides of the argument, the father of the New York requirement, chief judge of the New York Court of Appeals Jonathan Lippman, believes it will prevail as a force of good for the community. Lippman said “When I first put it out there, it made people nervous — the different constituencies, the law schools, the bar, the students. Everyone had some reason to sort of say, ‘Gee, we don’t want to be forced to do this.’” But ultimately the requirement, according to Lippman, has been a success. Larry Bellomo is an attorney with over 34 years of experience practicing in Laguna Hills, California. His law offices deal primarily with issues pertaining to Family, Divorce and Bankruptcy law. Give us a call or send a message today to receive your 100% free no obligation consultation.

Recent posts

January 28, 2018

January 28, 2018 According to an October 27, 2017, announcement, the Los Angeles jeans company, True Religion, exited Chapter 11 bankruptcy with about $357 million less debt, debt maturities extended, cash to implement a growth plan and a positive outlook for the future. The company emerges with a reduced retail footprint and an exit loan of $60 million from Citizens Bank, the same bank that provided the initial cash during the reorganization process. At the peak of the company, True Religion jeans were selling anywhere from $150 to $250 a pair at their nearly 140 stores and online. The brand also sold at upscale department stores, such as Bloomingdales, Saks Fifth Avenue and Nordstrom and at other locations in the U.S., Mexico and South America. Around 2013, True Religion, like many other apparel stores, struggled for success, watching sales decline as it competed with the internet, online shopping and competing discount retailers. The rapid growth in the trend of athletic wear for leisure caused the sales of blue jeans to quickly decline. Behind $192,000 on rent for its California office headquarters and drowning in major debts owed to creditors, manufacturers, U.S. Customs and Border Protection and malls around the country, True Religion filed for bankruptcy on July 5, 2017, in a U.S. Bankruptcy Court in Delaware. At the time of filing, the company had 128 stores in the United States and 11 stores outside the country. The company made some major changes, hiring John Ermatinger as CEO and president and bringing on a new chief marketing officer and a new vice president of sourcing. They also reduced costs, streamlined processes and closed unprofitable stores. John Ermatinger publicly thanked the company’s supporters — consumers, employees, vendors and suppliers — for their ongoing commitment and devotion to True Religion. He expressed his excitement regarding the future of the company, which includes implementing new growth strategies through innovative partnerships, expanding True Religion’s digital presence and refining its marketing operations. You do not have to be a major corporation to file bankruptcy , Like in the case of True Religion, bankruptcy allows individuals to emerge in a better financial position than before. Our legal team can help you navigate through these difficult times.

January 16, 2018

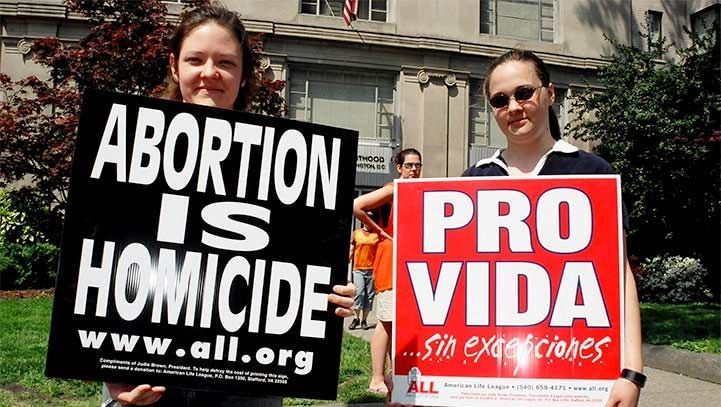

January 16, 2018 A Fresno State professor who intimidated a pro-life group was ordered to pay $17,000 and attend training on the First Amendment. He was recorded on video in an attempt to harass pro-life students who were drawing with chalk on the sidewalk. He also asked students from his public health class to assist him in his efforts. He claimed they were outside of the campus free speech area, but no such area has existed on campus since 2015. The sidewalk messages suggested pro-life options for students. The president of the club stated that the First Amendment gives students the right to speak on campus. She documented an incident between herself and the professor on video. He can be heard telling her that she is not in a free-speech area. However, she claimed that she had school permission to be there and to be speaking. The professor began erasing the sidewalk messages with his shoe. He told her that she did not understand the areas where free speech was permitted on campus. Alliance Defending Freedom acted as legal representation for the group, the Fresno State Students for Life. The professor must pay $1,000 to the president and $1,000 to another student as well as legal fees. However, he said that the money was paid by his insurance company, so he is not concerned about the legal fees. He does not admit to any wrong actions but is willing to attend the training so that he can learn the opinions and thoughts of others. The president expressed her relief that he will not be able to harass them again and explained that the case was not about winning money. She was extremely surprised at his actions, especially on a public campus. She further opined that professors should encourage and not prohibit free speech. Legal counsel for the pro-life group stated that the professor’s behavior flagrantly violated the First Amendment He added that school officials do not have the right to restrict freedom of speech on campus. The school did not comment about the case. If you believe that your First Amendment rights have been violated, you will need experienced legal representation to defend you. Contact us so that we can discuss your case.

January 5, 2018

January 5, 2018 The complexities of any divorce include dividing money, property and assets between both parties. While this might not be as complex for a millennial as it is for a couple who has spent their lifetime acquiring possessions, both types of divorce require finding a qualified family lawyer to deal with the personal issues. Legal experts report that stereotypes claim that other generations are more loyal than millennials who don’t really value traditions. She continues that even though they wait to marry, they still place a high priority on the institution. However, she added that they will not tough out a relationship the way their parents did. This by no means makes a divorce any easier for millennials. They feel just as hurt and disappointed as any others who divorce , but their outlook for the future tends to be more optimistic. Although marriage rates in the U.S. continue to decline, divorce rates are also dropping. Millennials delay marriage until later in life, placing an emphasis on education and careers before taking this significant life step. Millennials tend to be more open to diverse relationships, including living together. In the past, prenuptial agreements held a negative connotation as if one of the parties expected the marriage to end. The more-practical millennials, who prioritize acquiring and preserving wealth, see the prenup as a planning tool and communication map to manage financial expectations and interests. Creating a prenup with a lawyer realistically deals with the uncertainty of the future and helps a couple draft specific plans. Millennials choosing to live together instead of marrying can benefit from an attorney’s expertise when drawing up a cohabitation agreement, protecting both parties and their assets in case the relationship ends. When couples know the laws regarding cohabitation , marriage and divorce in their state, they tend to be ready for even unexpected contingencies. Whether a couple plans to cohabitate, marry or file for divorce, planning for a big relationship step helps the individuals prepare for the future, no matter what happens in the marriage. Consulting with a knowledgeable, experienced family lawyer sets up both parties for success.

December 23, 2017

December 23, 2017 The 32-year-old mother entered the high rise in downtown Memphis as a memory tugged at the far corners of her mind. Suddenly, it came to her. She had been in this very building with her own mother for the same purpose — to file bankruptcy . She anguished over the decision but a court order had recently enforced a judgement against her that allowed a company to seize a portion of her check. With her struggle to make ends meet, the judgment would put an unbearable strain on her already overburdened finances — the proverbial straw that broke the camel’s back. Despite the stigma, she decided that bankruptcy would stop the vicious cycle of juggling bills each month so that she could now start fresh. She even dreamed of becoming a homeowner one day. While the U.S. Bankruptcy Court for the Western District of Tennessee in Memphis funnels millions of dollars to the court, the lawyers and the creditors, the debtors for whom the entire system exists don’t fare so well. The clients are stuck in a vicious cycle. Most people choose to file Chapter 7, which allows the person to start over from square one without seizing any debts. In contrast, Chapter 13 requires monthly payments while stopping car repossessions and home foreclosures. This method is most common in the South and was what this mother chose. She didn’t understand the difference between the two. However, filers who opt for Chapter 13 must continue making payments for five full years. Most cannot even last 12 months under the program. These individuals went through each and every step of the bankruptcy — paying filing and legal fees and dealing with a seven-year blemish on their credit record — but do not ultimately benefit from the program. Once they have defaulted, they revert back to all unpaid debts with interest rates higher than ever. When comparing Caucasian filings with African-American filings, the latter usually file under Chapter 13 but cannot complete the program. Some return for repeat filings, with a few filing Chapter 13 up to 20 times during their lifetimes. They view bankruptcy as a last resort. If you are considering bankruptcy, talk to our knowledge attorneys about which options — Chapter 7 or Chapter 13 — is best for you.

Archive

Tags